A Method of Evaluating Capital Investment Proposals

Accounting rate of return. The method of evaluating capital investment proposals which uses present value concepts to compute the rate of return from the net cash flows expected from the proposals is.

Evaluating Capital Budgeting Decisions 8 Techniques Financial Management

Methods that ignore present value ANS.

. Past value methods B. Methods of Evaluating Capital Investment Proposals The methods of evaluating capital investment proposals are the following. Which method of evaluating capital investment proposals uses the concept of present value to compute a rate of return.

The rate of earnings is 10 and the cash to be received in one year is 10000. In capital budgeting internal rate of return is the method use in evaluating capital investments proposal that uses present value concept. Care must be taken when making capital investment decisions since a long-term commitment of funds is involved and operations could be affected for many years.

Average rate of return Od. 5 rows Following four methods are usually used for the evaluation of capital investment. Which method of evaluating capital investment proposals uses the concept of present value to compute a rate of return.

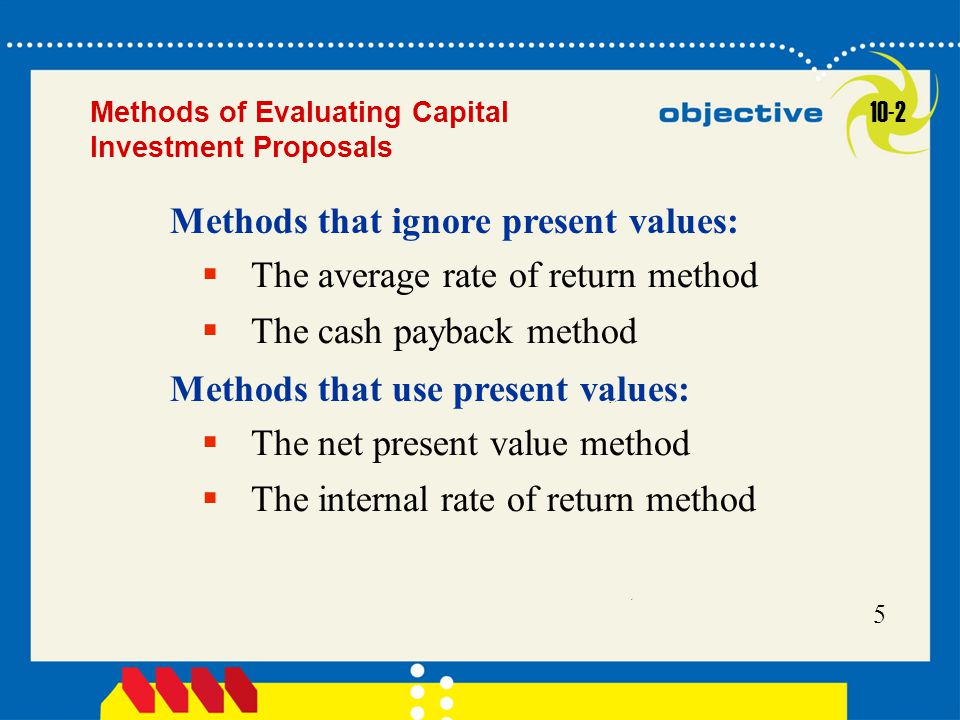

True The methods of evaluating capital investment proposals can be grouped into two general categories that can be referred to as 1 average rate of return and 2 cash payback. The methods of evaluating capital investment proposals can be separated into two general groups--present value methods and. Net present value method.

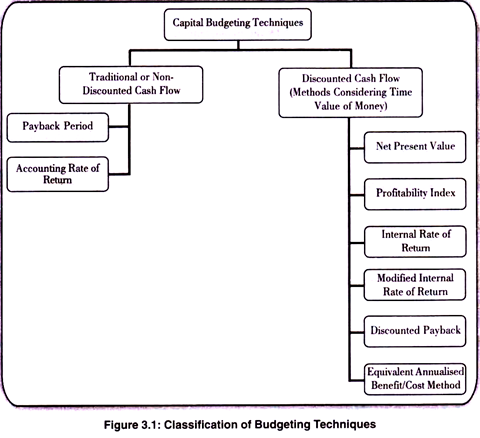

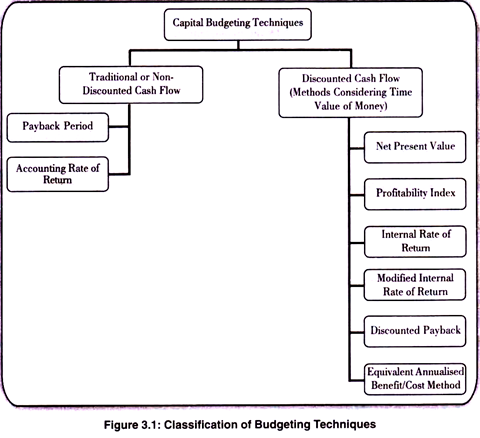

Evaluation of Investment Proposals. 1 average rate of return method and 2 cash payback method. The methods of evaluating capital investment proposals can be grouped into two general categories referred to as 1 methods that do not use present values and 2 methods that use present values.

Internal rate of return The method of analyzing capital investment proposals that divides the estimated average annual income by the average investment is. ________ method of evaluating an investment proposal uses present value concepts to compute the rate of return based on the investments expected net cash flows. If the alternative proposal involve different amounts of investment it is useful to prepare a relative ranking of the proposals by using a n Present value index.

The process by which management plans evaluates and controls investments in fixed assets is called capital investment analysis. The present value index is computed as ________. Total present value of net cash flow divided by amount to be invested.

The methods of evaluating capital investment proposals can be grouped into two general categories. Past value methods b. This method is employed to.

Cash payback period Oc. Internal rate of return. Which method of evaluating capital investment proposals uses the concept of present value to compute a rate of return.

This is another method for evaluating the capital expenditure decision using the discounted cash flow method. Methods that do not consider the time value of money. Cash payback methods D.

Internal Rate of Return Cash flows 1r i - initial investment. Internal Rate of Return IRR. AACSB Analytic IMA-Investment Decisions.

It is computed as follows. Internal rate of return Ob. It is computed as follows.

From the following information compute the discounted payback period of the project. When several alternative investment proposals of the same amount are being considered the one with the largest net present value is the most desirable. The methods of evaluating capital investment proposals can be grouped into two general categories referred to as 1 methods that do not use present values and.

The rate of earnings is 10 and the cash to be received in three years is 10000. In many situations in the life of a business concern an ad hoc decision is needed in respect of an. The methods of evaluating capital investment proposals can be separated into two general groups--present value methods and.

Cash payback methods d. Average rate of return. O Cash payback method.

The methods of evaluating capital investment proposals can be grouped into two general categories that can be referred to as 1 methods that ignore present value and 2 present values methods. In capital budgeting internal rate of return is the method use in evaluating capital investments proposal that uses present value concept. Chapter 10 Standard Costing 10.

Methods that ignore present value. This refers to the length of period or number of. The _____ method of analyzing capital investment proposals divides the estimated average annual income by the average investment.

Accounting rate of return. Under this method a stipulated rate of interest usually the cost of capital is used to discount the cash inflows. Internal Rate of Return Cash flows 1r i - initial investment.

This is also known as payoff and pay out method.

Capital Investment Analysis Ppt Video Online Download

What Are Capital Budgeting Techniques Definition And Meaning Business Jargons

Briefly Explain The Traditional And Modern Methods Of Capital Budgeting

No comments for "A Method of Evaluating Capital Investment Proposals"

Post a Comment